What we're reading about, 5/31/24

Climate, energy, and sustainability coverage we've been following around the web

(1) The Biden administration announced the first set of government guidelines for voluntary carbon markets (VCMs), often called carbon offsets or carbon credits. The short document begins by talking up the benefits of carbon credit markets, focusing on their potential in helping to mobilize private capital behind emissions reductions.

It also acknowledges some of the controversies regarding carbon credit markets (i.e. whether the projects they fund actually curb emissions) and underscores the role of the government in promoting “robust” standards in order to instill “needed market confidence.”

In the words of the document’s authors (which include Treasury Secretary Janet Yellen):

“Put simply, stakeholders must be certain that one credit truly represents one tonne of carbon dioxide (or its equivalent) reduced or removed from the atmosphere, beyond what would have otherwise occurred.”

The guidelines are organized into seven key principles for “responsible participation” in VCMs. Below, we outline each one. The big takeaway is that the principles encourage off-takers to first focus on emissions reduction in their own value chains, use “high-integrity” carbon credits as a backstop to offset residual emissions, and publicly disclose all their carbon credit activity.

Carbon credits and the activities that generate them should meet credible atmospheric integrity standards and represent real decarbonization.

Credit-generating activities should avoid environmental and social harm and should, where applicable, support co-benefits and transparent and inclusive benefits-sharing.

Corporate buyers that use credits (“credit users”) should prioritize measurable emissions reductions within their own value chains.

Credit users should publicly disclose the nature of purchased and retired credits.

Public claims by credit users should accurately reflect the climate impact of retired credits and should only rely on credits that meet high integrity standards.

Market participants should contribute to efforts that improve market integrity.

Policymakers and market participants should facilitate efficient market participation and seek to lower transaction costs.

Reading through these (and the actual policy statement does not get much more concrete), it should be obvious that these guidelines are neither binding nor enforceable. But, per the New York Times, “proponents of voluntary carbon markets say they could help foster a larger market for high-quality offsets that actually work.” By some estimates, the voluntary carbon market could grow to 10 or even 20 times its current size, which was approximately $1.7 billion in 2023.

Nonetheless, critics are already calling out the statement for its vagueness, and lack of red lines on on credit quality that state and federal regulators could align around. The Times quoted climate policy expert Danny Cullenward: “Absent the government doing something to address the bottom of the market through enforcement, I don’t see any of the low-quality credits going away.”

(2) The Science Based Targets initiative (SBTi) certifies whether an organization’s climate targets are in line with the economy-wide level of emissions reduction needed to keep global warming below 1.5C, and recently incited controversy over its (now-retracted) statement regarding the use of “environmental attribute certificates” (EACs) for offsetting Scope 3 emissions (i.e. credits and offsets).

New reporting by Bloomberg reveals some of the internal shifts at SBTi over the past year that led to their controversial stance on EACs. For example, last September SBTi went from being a collaboration between three NGOs and the UN to an independent entity governed by a board of trustees (including, as Bloomberg points out, several people with an interest in growing the offsets market).

(3) ExxonMobil shareholders voted in line with board recommendations on all shareholder proposals despite recent vocal opposition from a couple large investors, including CalPERS and the NYC Common Retirement Fund, as we’ve written about in previous editions of this newsletter.

All twelve incumbent directors were re-elected with an average of 95 percent support. The worst-polling director, Lead Independent Director Joseph Hooley, was backed by investors holding 87 percent of ExxonMobil shares, while CEO Darren Woods was re-elected with 92 percent support.

(4) ConocoPhillips (COP) is acquiring Marathon Oil (MRO) in an all-stock deal valuing the target at $22 billion, including debt, sending the stock up 15 percent from its pre-announcement price. On trailing-twelve-month metrics, the acquisition comes at a valuation of ~5.0x EV/EBITDAX and a ~12% free cash flow yield to the equity. MRO’s lifting, marketing, and DD&A expenses per oil-equivalent barrel of production are around ~$28-29 for its US business and ~$12 for its international business (Equatorial Guinea-based natural gas operations).

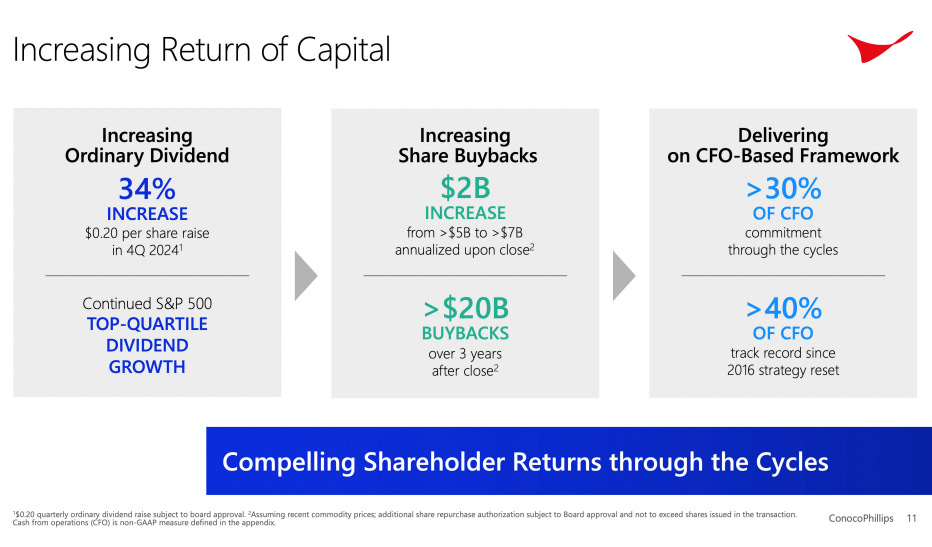

Eyeballing the company’s financials, MRO should generate a ~15% ROCE (before G&A) above $49-50 per oil-equivalent barrel of production versus an average realization of ~$46 (across crude and condensate, natural gas liquids, and natural gas) in Q1 2024. COP identified $500m in potential cost synergies (~12.5% of MRO’s US operating costs) and, interestingly, also announced increased capital returns alongside the deal. The cost synergies will reduce MRO’s cost per barrel of production by about ~$4.

(ConocoPhillips)

Strikingly, MRO had only ~10 years of reserves at year-end 2023, and over 2021-23, only managed to add 399m oil-equivalent barrels of reserves through extensions and discoveries, just enough to tread water versus production of 400m boe. Exploration and development expenses over that period totaled ~$19 per boe, on average, slightly higher than ~$16 of DD&A per boe last year.

Further Reading:

Will Northern Virginia’s status as a data center hub compromise the state’s climate goals? (Inside Climate News)

“Residual emissions” - the leftover emissions that will have to be dealt with through carbon-negative technologies - make up 5-52% of peak emissions under national net-zero plans (One Earth).

Could clinker reclaimed from old buildings help decarbonize cement? (New Scientist)

50 percent of the world’s mangrove forests are at risk of ecosystem collapse (IUCN).

“Climate finance” from developed nations to the Global South includes a lot of market-rate loans, channeling billions in interest back to lenders (Reuters).

New Zealand planted too many trees (Bloomberg).