Here comes the sun

The rise of the US solar industry

Note: This pieces draws on the Jain Family Institute’s recent memo on US solar module production. I was heavily involved in drafting the piece, and encourage anyone interested in reading more to check out the full report. Also, in this note, I use the terms “solar panel” and “solar module” interchangeably.

Utility-scale solar is by far the most impressive energy transition growth story to date. Twenty years ago, in 2004, there was no utility-scale solar power being installed in the US.1 Out of the c. 38 GW of utility-scale generators connected to the grid that year, 31 GW (83%) were natural gas plants. Ten years ago, in 2014, 3.4 GW of solar capacity came online in the US - 18% of the 19 GW of new power plant capacity across all technologies. In 2024, the US is on track to add 37 GWac of utility-scale solar. Not only is this a ten-fold increase over a decade, it makes solar the single biggest source of new generation capacity (59%).

Batteries - often co-located with solar and wind projects - are the second-biggest, at 24% of ‘24E capacity additions.

(EIA Electric Generator Monthly Inventory)

In addition to these large-scale solar projects, in Q1 2024, ~2 GW of smaller-scale residential, commercial, and community solar was installed across the US (down about 18% year-over-year). Assuming an average inverter loading ratio (ILR) of ~1.3x for the utility-scale projects, this run rate implies ~54-56 GWdc of total solar module demand for the year.2

The vast majority of these solar modules are imported - primarily from four countries in Southeast Asia (Cambodia, Malaysia, Thailand, and Vietnam). The Southeast-Asia-to-US solar trade route is a product of trade policy as much as economics. After all, the vast majority of manufacturing capacity along the solar value chain is located in China, not Southeast Asia: 79% of polysilicon capacity, 97% of wafer capacity, 85% of cell capacity, and 75% of module capacity.3 Over the last 12 months (as of May 2024), exports from these four countries to the US totaled c. 52 GWdc, which added up to 83% of US imports. Imports from all countries combined were c. 70 GW - roughly 1.27x my estimate for US demand in ‘24E.

(US ITC DataWeb)

Since 2012, the US has applied a range of tariffs to solar panels imported from China (see the below graphic from S&P Global for a timeline). However, over the last two years, most solar panels came into the country duty-free, because of tariff exemptions for (1) panels from Southeast Asia and (2) two-sided panels, which together cover nearly all imports. Both of these exemptions expired this year.

Meanwhile, in August 2023, the Department of Commerce determined that Chinese manufacturers were circumventing tariffs by exporting panels with primarily Chinese content through Southeast Asia. More recently, in June, the International Trade Commission found that panel imports from Southeast Asia made without certain Chinese-origin components were also harming US-based manufacturers, which will likely lead to Commerce imposing further tariffs. The takeaway is that US tariffs on Chinese solar modules helped drive the growth of a module manufacturing industry in Southeast Asia; now, US trade policy, combined with incentives for domestic manufacturing under the Inflation Reduction Act, is shifting module assembly onshore.

(S&P Global)

As a result of this unique solar “trade route,” the US pays a premium for its solar imports. In May, the customs value of US solar module imports from Southeast Asia averaged $266 per kWdc. Over the last 12 months, it’s averaged $303 per kW. By contrast, the spot price for Chinese solar modules through March 2024 was just $140, and more recent estimates from PV InfoLink are even lower, at $110 per kW for TOPCon modules. The Chinese module industry suffers from overcapacity, and leading manufacturers are struggling with negative gross margins. But even allowing for “normalized” margins that would allow them to earn an adequate return on capital, it’s hard to see how their cost of production could be much more than $150-200 per kW.4

(US ITC / BNEF)

(BNEF)

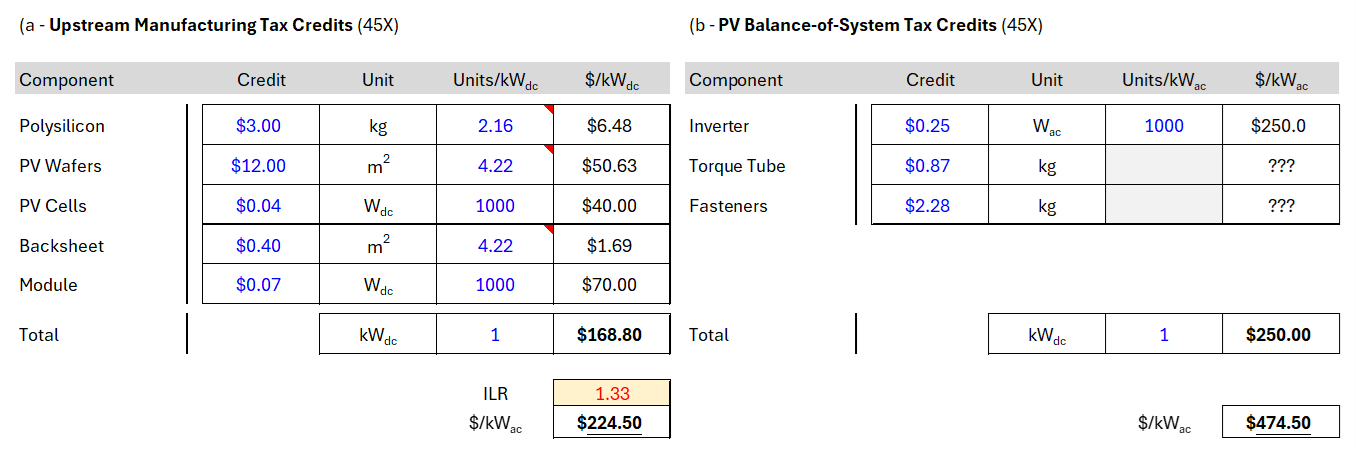

Another way of looking at it would be to focus on the spread between the price of solar cells imported into the US and the price of fully assembled modules. In recent months that gap was about ~$100 per kW. The new goal of US solar policy is evidently to capture that “margin” from its trade partners and use it to generate domestic employment and GDP. Hence the extremely generous tax credits for making solar modules onshore:

Manufacturers are responding to the combination of aggressive tariffs and tax credits by building lots of domestic module manufacturing capacity, very quickly. If all the projects in the domestic module manufacturing pipeline get built, there will be enough US-based factories to produce 78 GW of solar panels a year, or roughly ~1.4x ‘24E demand.

The financial logic behind this surge in investment is relatively straightforward. A US manufacturer building a new solar module factory should be able to earn at least a 12% IRR by selling panels in the low $300s per kW,5 which is higher than the landed cost of imports in recent months, but lower than the cost of imports as recently as last fall, and definitely lower than the cost of imports going forward with the resumption of tariffs on most Southeast-Asian-origin panels.

One implication of all this is that the ‘35E mix of solar energy in the US electric grid could surprise to the upside. It’s harder to unbuild things than to build them. Once the US has 70-80 GW of operating solar module capacity, much of it built by overseas manufacturers selling upstream content into the panels, I suspect we will be deploying close to 70-80 GW of solar modules a year. At 2.5-3.0% annualized growth in electric generation6 that implies 22-25% solar share in 2035.

The main takeaway here is that green industrial policy - combined with the protectionist turn in US trade policy - is succeeding in building domestic clean-energy industries that are large enough to meet domestic demand even under more aggressive deployment scenarios. How well this generalizes beyond solar, batteries, EVs, and the upstream materials used in these industries is TBD. But it does suggest that (heavily subsidized and protected) domestic manufacturing capacity will set a high floor under future deployment trends.

Postscript: It should be noted that this kind of aggressive trade and industrial policy is not without risks. For example, the US will be a net importer of upstream solar materials (cells, ingots/wafers, and polysilicon) for the foreseeable future. Policymakers want to use tariffs and tax credits to onshore green industries, while maintaining access to cheap imports of raw materials and intermediate goods. Whether it’s possible to achieve both (without completely ruining US trade relationships) will vary from industry to industry.

This is based on the June 2024 edition of the EIA’s Electric Generator Monthly Inventory.

The ILR is the DC:AC ratio for an installed solar system - in other words, it’s the ratio of the solar panel’s output (measured in Watts-DC) and the output of the inverter (measured in Watts-AC). Solar panels produce their maximum power output very infrequently, so it’s usually more efficient to “oversize” a solar system.

The key steps of the solar panel production process, from start to finish, are purifying silicon metal to create polysilicon, growing crystalline polysilicon ingots, slicing those ingots into ultra-thin wafers, treating those wafers to turn them into photovoltaic cells, and, finally, assembling cells into modules - solar panels.

Most of the large Chinese OEMs have public financials on Bloomberg. The napkin math is simply the unit gross profit that solves for a >= 12% return on capital employed, assuming >= 60% capacity utilization.

See the sample project DCF below for illustrative assumptions - please let me know if you have any questions or pushback on the modeling!

This is ahead of most traditional modelers, e.g. IEA’s Electricity 2024 assumes 1.5% annual growth from 2024 to 2026; however it might seem low to e.g. big AI bulls.