Fixed vs. Floating

The deeper meaning of the offshore wind crisis

Fixed vs. Floating

The offshore wind (OFW) energy industry is widely reported to be in crisis. Higher interest rates and construction costs are leading developers to pull out of projects in both Europe and the United States, taking large impairment charges when they walk away from wind farms that no longer pencil.

The problems facing the industry have been in the cards for the last year or two as inflation and the cost of financing ticked up in much of the world. That said, the pace of bad announcements from companies in the OFW value chain (and governments trying to incentivize the growth of the OFW industry) definitely accelerated over the past 3-6 months.

Mechanically, renewable energy comes with de minimis variable costs, but much higher fixed costs than electricity derived from fossil fuels. Thus, the lifetime average costs of a particular wind farm or solar installation (often framed in terms of LCOE) are more sensitive to transient changes in the cost of key components (turbines, solar modules, etc.) and the cost of financing at the time of construction than the equivalent thermal plant. A 10% increase in the construction cost of building an OFW farm flows through almost 1:1 to levelized costs (+8%), while a new gas CCGT plant is much less sensitive to changes in construction and key equipment costs (+5%).1

Stories about the “crisis” (which I’m applying scare quotes to only to emphasize the discursive character of crisis, not to suggest all is well in OFW) tend to emphasize either the financial challenges facing developers or the setbacks facing governments around the world as they solicit private sector interest in building OFW wind farms.

These are really two sides of the same coin. The key dynamic to pay attention to in the background is the reliance on long-term, fixed-price (or quasi-fixed price) off-take agreements for renewable energy projects. In order to lock in project economics, both onshore and offshore wind developers will sign 20+ year deals through various frameworks (e.g. the UK’s CfD scheme, ORECs in various US states, corporate PPAs, etc.). Long-term visibility into the prices a wind farm will receive for the electricity it will generate removes that biggest source of uncertainty lenders and investors have to grapple with to underwrite a project. It allows developers to lower their cost of capital, which in turn allows them to bid more aggressively in competitive CfD/OREC/PPA allocation processes (note the circularity here).

But these long-term agreements, which the industry has relied on to provide highly visible, well-above-market revenue (see below for an illustration of the cumulative premium wind farms in Denmark have earned above the market price for electricity) have become an albatross, locking in economics that developers can no longer deliver on. I think the analogy is a little too cute, but I’m tempted to compare the industry’s dilemma with the regional bank crisis earlier this year – like the most vulnerable banks, OFW developers are saddled with a portfolio of too many ~fixed “assets” (contractual revenue) matched with ~floating “liabilities,” i.e. the cost of constructing wind farms, juiced by inflation.2

As of earlier this year (i.e. including the now-canceled Ocean Wind 1 and Ocean Wind 2 projects), the average pending OFW project in the US had a planned “first power” date 6.6 years in advance of reaching a PPA/OREC deal to lock in revenue. This is an incredibly long time, and it’s simply not possible to fix 100% of the EPC costs needed to build a wind farm that far in advance – in addition, it’s reasonable (or at least defendable) to leave some of your equipment and contracting needs TBD if you believe costs will go down.

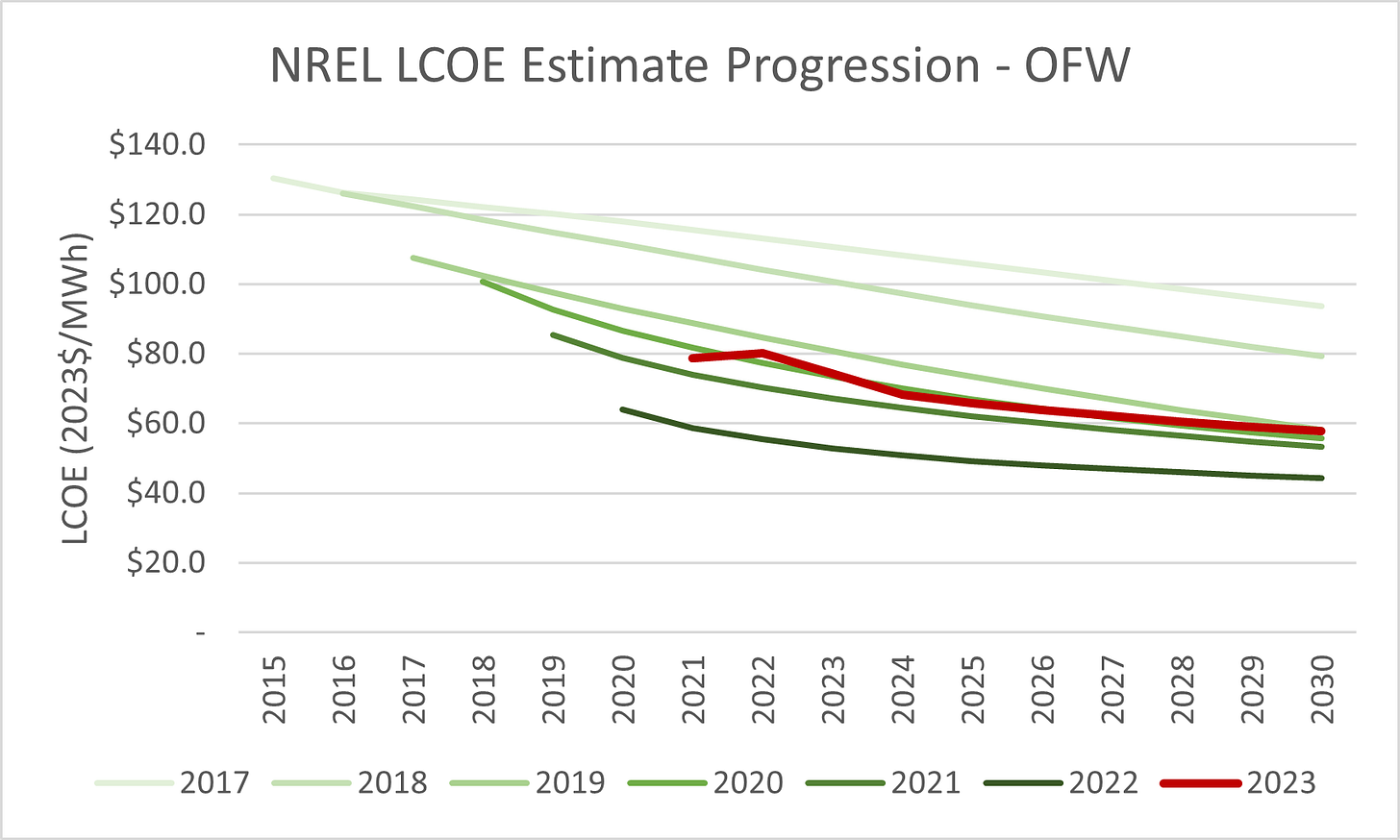

Said another way, the majority of these deals were entered into in a period when (in the US) the cumulative inflation seen over the ~6 ½ year construction timeline of an OFW project had drifted down to around 10%. Conversely, operators could also point to reputable sources like IRENA and NREL’s ATB that showed (i) the industry had achieved ~HSD annual cost reductions since 2010 (!) and (ii) that it was forecast to keep delivering at least ~LSD annual cost reduction for the foreseeable future. If you believe conditions like these will continue, it’s rational to transact for at least some of your future equipment/material needs on a ‘spot’ basis rather than committing to today’s prices.

OFW Offtake Mechanics

At their Capital Markets Day earlier this year, the Danish OFW developer Ørsted stated they had 50% “inflation-indexed” revenue exposure across their in-place fleet and pipeline of OFW, onshore wind, solar, and biomass plants. This looks like about the right ratio for their in-place OFW fleet as well, though it’s important to note that the quality of inflation protection varies a lot across these contracts.

For example, CfDs, which are used in the UK, are based on a “strike price” concept, which pays out difference between the strike price and the market price of power to a project developer. The strike price is indexed to CPI over the length of the contract, but in an environment where higher energy prices are leading overall inflation, it’s likely that the price-indexing feature wouldn’t fully offset a squeezed margin between the strike price and the reference price. Also, operators who have agreed to sell power via a CfD have to protect themselves against volatility in the price of power. If they can’t sell enough power to offset the cash settlement of the CfD when the reference price is above the strike price (“volume insufficiency”), for example, their hedges can become ineffective.

Conversely, the old “renewable obligation certificate” (ROC) model used in the UK (which has been phased out for new projects) allowed OFW developers to earn a fixed number of (inflation-indexed!) ROCs per MWh of electricity generated. This model provided a fixed floor of ~2x the reference price of electricity while allowing for upside if prices were to surge higher, as happened starting in Q3 2021.

The important point here, though, is that what Ørsted calls “inflation-indexed revenue” really does only protect them against inflation, and not (as one might think) inflation-related cost overruns. Getting paid a fixed price that goes up in line with CPI every year does not mean you aren’t in serious hot water if your wind farm costs 25% more than you thought it would when you were awarded a long-term contract with the host government. It just means that you don’t get into progressively worse trouble over time.

Another observation that drops out of this work is that on average, the prices Ørsted earns for the power it generates are still very high. It’s easy to focus on the prices in the latest auctions, which deployment lags behind for a few years, and to focus on the price of power from the wind farms that Ørsted (or any other developer) brings online in a given year, which the average pricing of power from the entire OFW fleet will lag behind even farther. The reality is that Ørsted’s wind farms are still, on average, generating revenue at highly subsidized rates driven by projects built earlier in the previous decade. The industry simply has not had to “realize” the economics of projects that were priced in the period from roughly 2019-22.

Another data set that tells a similar story is the pricing of long-term off-take agreements for the US OFW industry, which from 2017-21 touched and briefly overshot IRENA’s (global) levelized cost estimates, despite a number of US-specific challenges that developers knew they would encounter, like teething problems with managing O&M expenses and a dearth of Jones Act compliant vessels to support installation. Falling prices on awarded contracts validated the story that costs were coming down, but these prices just reflected developers’ financial modeling, not any substantial offshore wind farms in operation (Block Island, which represents c. 70% of the US’s OFW capacity in operation, sells electricity at ~$310/MWh, well above the top of this chart).

Narrative Violation

So what does all this actually mean for the energy transition?

Strange as it may sound, it’s not obvious that the OFW industry’s challenges will manifest in worse-than-expected deployment over the long run. That’s partly because so much of the demand for OFW is scarcity driven – governments around the world have set big goals for rolling out OFW, including hard procurement quotas in many cases. Third-party estimates from BNEF and 4C Offshore for OFW capacity additions have actually drifted higher over the last few years, though the positive revisions are weighted toward the latter half of the decade.

Another crucial piece which is generally underplayed in the press is the rapid growth of the Chinese OFW industry. Over the period from 2023-25, BNEF is forecasting China driving 60% of global OFW capacity additions, before gradually drifting down to < 25% of adds by the end of the decade. Perhaps – but I wouldn’t be surprised if Chinese capacity growth continues to surprise to the upside, while capacity additions ex China disappoint.

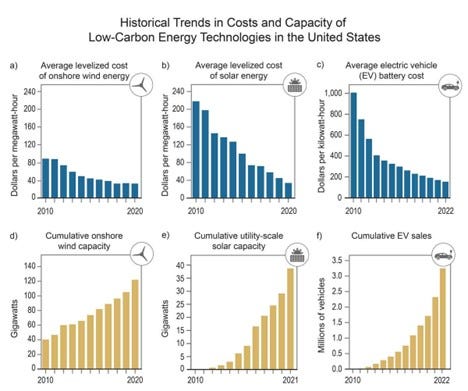

More deeply, I think there’s a lesson in the dangers of putting too much faith in the power of the experience curve. I was struck by this exhibit from the most recent National Climate Assessment, essentially the US Government’s version of the IPCC Report, released just the other week.

Obviously, OFW is not featured on this infographic, and nothing that’s happened year-to-date in the OFW industry directly “refutes” the (encouraging) story portrayed here in any 1:1 way. But the way this illustration is framed is telling. “Plummeting costs” solve for “economic feasibility,” which means “we know how to drastically reduce emissions.”

That renewables are now cheaper than energy from fossil fuels - or are at least on their way - has become a dominant popular narrative of the energy transition. There is no trilemma of more energy, cheap energy, and green energy - we can have all three.

This isn’t a totally unreasonable way of looking at things. Solar and onshore wind, for example, really have proved themselves as cost competitive alternatives to new gas-fired power plants, and have substantial headroom for future capacity additions, especially when paired with storage and transmission investments.

It also is key to making the political case for subsidies directed at scaling new technologies. If subsidies buy local cost reductions due to learning-by-doing, it helps mitigate the question of zero-sum distributional conflict. Without catalyzed cost reductions, supply-side interventions to deal with market failures around investing in risky, early-stage technologies become carbon taxes by another name. Setting aside whether carbon taxes (and similar policies) are a good idea or not, there’s a reason why they have gotten far less traction than the emerging toolkit of green industrial policy.

But it can be dangerous to take ever-falling costs and ever-increasing adoption for granted. The challenges facing the OFW industry rise to the level of a “crisis” because they imply a temporality of fits and starts (or booms and busts) rather than the smooth, continuous progress many have come to expect.

The open question is how the political coalitions that are forming worldwide around visions of “green growth” will deal with the possibility that not every low(er)-emissions technology will experience the exponential cost declines that solar, batteries, and onshore wind have benefitted from. Will policymakers (and voters) still want OFW if it turns out they will have to pay >> $100/MWh for it?

Author’s modeling. Offshore wind estimates reflect global weighted average capacity factors and capital costs in 2022, from IRENA, with the latter adjusted for inflation, and O&M estimates from the 2023 NREL ATB. Capital cost and O&M estimates are from the EIA (also inflation adjusted). Both projects modeled with 60/40 debt/equity mix, 7% interest, and a 12% target equity IRR. OFW cost is unsubsidized. I assume a 42% capacity factor for the OFW plant and 55% for the gas plant, and use $3.45 gas.

Ørsted likes to talk about how they match the long-term contractual revenue of their projects with fixed-rate debt, but as with inflation indexation, this only locks in the economics of a wind farm ~at the time it’s put into service. Cost overruns between the contract award date and first power remain a serious risk for the model.