What we're reading about, 5/17/24

Climate, energy, and sustainability coverage we've been following around the web

(1) CalPERS, the nearly ~$500bn California public pension system, publicly criticized ExxonMobil’s decision to sue two activist shareholders (Arjuna Capital and Follow This) for filing a resolution calling for Exxon to cut its Scope 3 emissions - in effect, to pull back from its core business of selling hydrocarbons.

Per Reuters, a CalPERS spokesperson said that the fund “remain[s] concerned about any action that could undermine shareholders’ basic rights.” CalPERS is voicing its displeasure ahead of the oil and gas major’s annual meeting on May 29th. Mission-driven investors like Wespath (the investment arm of the Methodist Church), Majority Action, and the Illinois State Treasurer have called for shareholders to vote against re-electing the company’s CEO (Darren Woods) and Lead Independent Director (Joseph Hooley) to the company’s board.

The strange thing about ExxonMobil’s lawsuit is that it seems almost certain that the SEC would have granted the company “no-action relief” and allowed them to exclude Follow This’s proposal anyway. This is what Rule 14A-8 says about resubmitting shareholder proposals:

(Cornell Legal Information Institute)

The Follow This proposal is clearly eligible for no-action relief, having been voted on twice in the past five calendar years, and, most recently, garnering less than 15 percent of votes cast.

(SEC Filings)

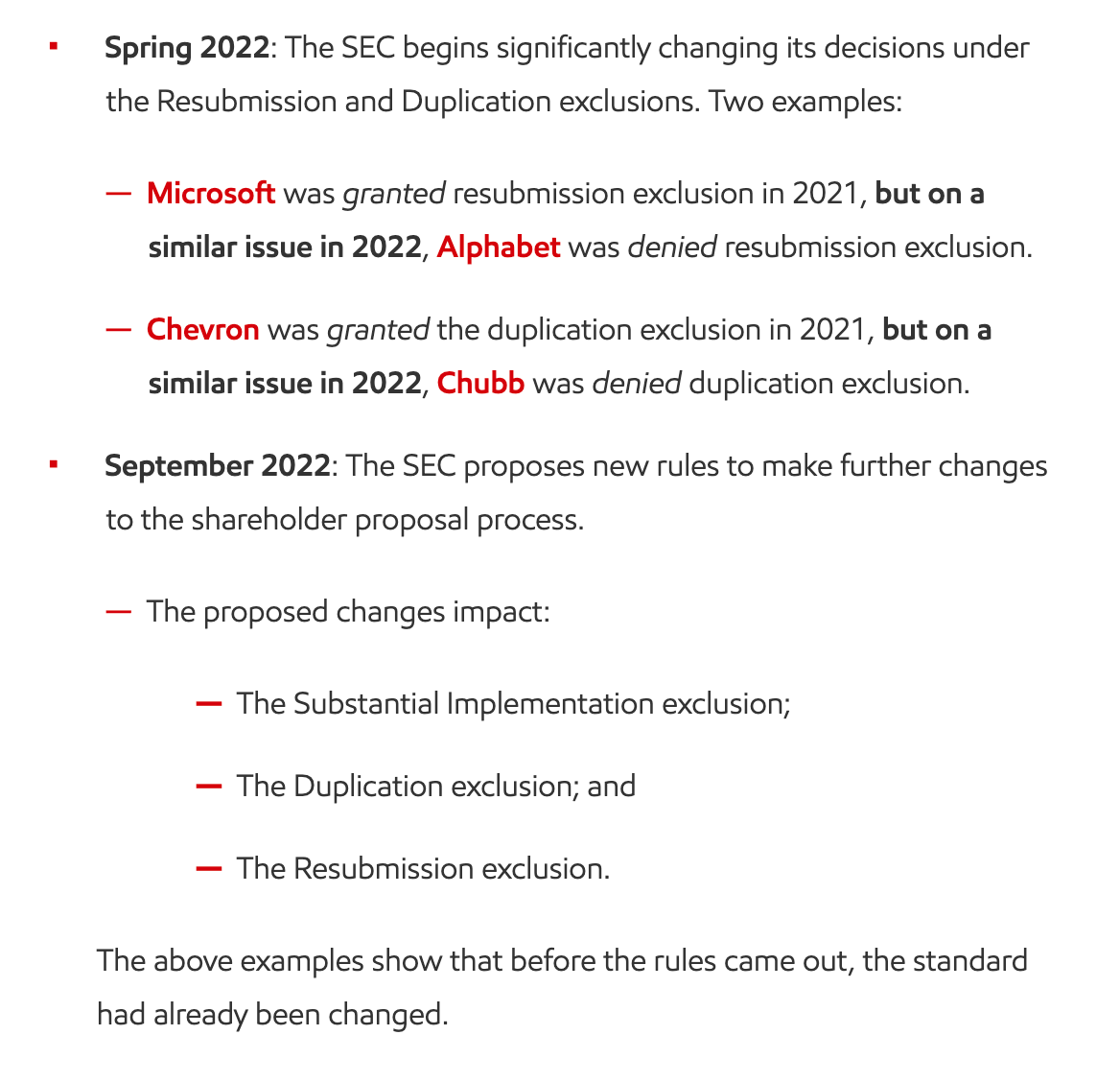

So what exactly is ExxonMobil trying to achieve with this lawsuit? The company has publicly laid out its account of the fact pattern on its website. The crux of this issue seems to be that ExxonMobil is arguing that the SEC is not granting no-action relief formulaically, according to the fairly clear guidelines laid out in rule 14a-8, but has instead de facto changed the duplication and resubmission exclusions. By suing to prevent the submission of the proposals in district court, ExxonMobil is effectively saying that they don’t trust the SEC to execute the letter of its own rules on shareholder proposals.

Nevertheless, it’s a little hard to understand the legal and PR strategy here. Rule 14A-8 is clear - the Follow This proposal was clearly eligible for no-action relief. And, even if it had gone to a vote, it would have probably garnered the support of investors holding no more than 10 percent or so of ExxonMobil’s shares - not exactly a threat to the incumbent board and management team. Both sides seem more focused on winning a symbolic victory than on the core sustainability issues facing Exxon.

(2) Modeling shop Ember came out with the 2024 edition of its Global Electricity Review, highlighting another impressive year of growth for renewable electricity generation - but not quite enough growth to offset ever-increasing demand for electricity. Still, with solar and wind capacity additions set to grow over the next few years, a peak in fossil electric generation is in sight.

From 2001-2023, global electricity demand grew by about ~600 TWh per year. Renewable generation growth was around ~500 TWh in 2022 and 2023, and, based on Wood Mackenzie estimates for solar capacity additions and GWEC forecasts for wind projects, low-carbon generation could be growing at roughly ~1 TWh per year by the end of the decade, just enough to supply ~2-3 percent annual growth in electricity demand and start to make a dent in fossil generation - albeit a vanishingly small one.

It’s exciting to see “peak fossil electricity” in sight - perhaps as soon as this year or next, depending on demand growth (the IEA forecasts a very robust 3.3 percent increase for this year) and a recovery in hydroelectric generation, which declined over the last two years. And yet, the pace of renewable deployment will have to increase several-fold in order to really drive down global electricity-sector emissions - let alone energy emissions as a whole.

(Ember, Statistical Review of World Energy, Wood Mackenzie, GWEC)

(3) Canary Media is out with a deep dive on so-called “zombie coal plants” - plants that don’t breakeven on an energy sales basis but are kept alive by capacity payments and other non-market mechanisms because grid planners need them to provide backup generation. The piece talks about “Kafkaesque rules” keeping coal plants like Maryland’s Brandon Shores Plant online, but the real story is a bit more prosaic (if depressing) - as one expert quoted in the piece puts it:

“There’s no action until the plant owner announces they’re going to close … PJM [the market operator] must do an analysis in something like 60 days or 90 days to determine if there are impacts from those closings and then come forward with solutions to those impacts.”

(Canary Media)

What’s basically happened is that Brandon Shores’ owner - Talen Energy, an independent power producer (IPP) - wants to shut down the plant, but doing so would create system reliability issues under various stress-test scenarios. To resolve the issue, PJM will pay Talen (the piece talks about a $250m per year payment) under a “reliability must-run” (RMR) agreement until certain grid upgrades are completed in 2028.

Brandon Shores really is an outrageously inefficient and uneconomic plant. In 2023, its heat rate - a measure of thermal efficiency - was over 13,000 btu per kWh, compared to an average of 10,689 for coal plants nationwide and 7,740 for natural gas plants (lower is better). Coal deliveries to the electric power sector in Maryland are also about two-thirds more expensive than the US average, compounding the problem. The result is that the plant’s capacity factor has been falling continuously over the last few years, and it is now only used during the summer, when air conditioners run at full strength and peak power demand is highest.

(EIA)

Fuel costs alone for Brandon Shores average $40 to 60 per MWh (depending on coal prices), compared to overall energy prices in PJM ranging from ~$20 to 40 per MWh in recent years (outside the energy price spike of late 2021 and 2022).

(PJM)

Brandon Shores is emblematic of a lot of coal plants in the US. Coal has been pushed farther out the merit curve by efficient combined-cycle gas plants burning cheap shale gas. But the economics of steam-turbine coal plants don’t support “peaking” operations, since coal plants have large fixed costs that they need to defray. Meanwhile, grid reliability (and the burgeoning queue of generation and transmission projects waiting to be built) demands that these fossil plants stay in business in order to provide backup power. The key for those focused on state-level policy (out of our wheelhouse) will be to channel this tension in a productive way - highlighting the substantial cost to ratepayers and the climate of holding up investment in the grid.

Elsewhere: Vermont goes 100 percent renewable (Electrek); solar storms delay planting season (New York Times); climate scientists think 1.5C is now a pipe dream (The Guardian); record net long positions by commercial grain traders (Goehring & Rozencwajg).