What we're reading about, 3/15/24

Climate, energy, and sustainability coverage we've been following around the web

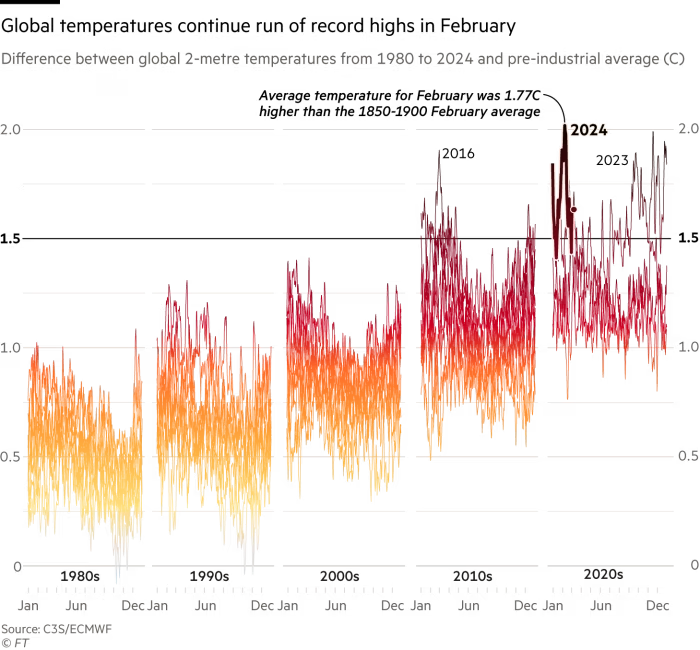

(1) The global average temperature in February was 1.77C above pre-industrial levels, i.e. the average from 1850 to 1900. That makes February the ninth month in a row of record heat:

(Financial Times)

Over the past 12 months, the global average temperature anomaly averaged 1.56C above pre-industrial levels. So where does this leave the 2015 Paris Agreement goal of keeping global temperatures “well below” 2C above pre-industrial levels, and ideally below 1.5C? The Paris Agreement represents a commitment to limit the “long-term” rise in global temperatures - but it doesn’t define what “long-term” means, what data set to use, or what reference period to compare recent temperatures to. It’s hard to deny that we are already close to breaching the 1.5C limit.

Per the Financial Times, which covered the temperature news, GHG emissions need to be cut by almost half by 2030 - now just six years away - to align with a 1.5C warming target.

(2) Bloomberg Businessweek’s Saijel Kishan dug into the growing academic skepticism around research showing a positive relationship between corporate sustainability and stock market returns. As BU professor Andy King put it, “the evidence supporting ESG just wasn’t solid.” Researchers aren’t saying that companies should turn their backs on decarbonization. Rather, they’re questioning research that claimed to show doing good for the planet would automatically be good for shareholders, too.

For example, three academics at Berkeley challenged some of the original research claiming to show that higher ESG scores were positively associated with investment returns, arguing that it was confounded by other factors correlated with ESG scores (emphasis mine):

“Our basic premise is that changes in material ESG issues reflect fundamental firm characteristics. More financially established firms—firms with larger size, lower growth, and higher profitability relative to their sector—are more likely to not only create material strengths but also resolve material weaknesses in their ESG scoring. This fundamental link dictates that one should comprehensively control for fundamental determinants of stock returns before attributing portfolio outperformance to improving material ESG scores. Indeed, we find that the materiality portfolio does not generate alpha after we account for its exposure to profitability and growth factors.”

(3) According to the IEA’s new Methane Tracker report, global methane (CH4) emissions from fossil fuels neared record highs in 2023. The agency estimates that fossil fuel production generated ~118 million tonnes of methane emissions in 2023, with another ~10 million tonnes coming from biofuels.

(International Energy Agency)

Because most methane emissions are either “fugitive” emissions (think gas leaks or oil well flaring) or from highly diffuse sources (cattle barns and landfills), measuring global methane emissions has been notoriously difficult, though an increasing number of satellite-based measurements have become available.

On the positive side, it does appear that the methane intensity of fossil fuel production has been declining slightly. In the inaugural, 2022 edition of the IEA’s methane tracker, the agency calculated that fossil fuels and bio-energy were responsible for ~135 MT of CH4 emissions. That’s fallen to ~128 MT in the latest edition, even as fossil fuel consumption has continued to grow.

While progress is being made in some regions and industries, the fossil fuel industry still has to cut methane emissions by 75 percent over the next six years for the world to have a chance at staying within the Paris limits. Christophe McGlade, the head of the IEA’s energy supply unit and lead author of the latest report told Bloomberg:

“If we can’t make real progress on cutting down on methane it’s going to be impossible to limit warming to 1.5C… While emissions are still high, in our view 2024 is going to be a watershed moment for action and transparency.”

(4) Pittsburgh-based natural gas producer EQT announced that it will acquire pipeline business Equitrans Midstream, in an all-stock deal, offering a little over a third of a share in EQT for each share of Equitrans, or about ~$5.7 bn at pre-announcement prices. The offer represents a roughly 15 percent premium for Equitrans, and, including the pipeline company’s net debt, values it at around ~$12 billion.

The deal has a somewhat interesting backstory, since EQT is now run by the Rice brothers, who sold their exploration and production business to EQT in 2017, and their pipeline business to Equitrans in 2018. The Rice team then went activist on EQT, and the deck from their activist campaign was scathing:

(SEC)

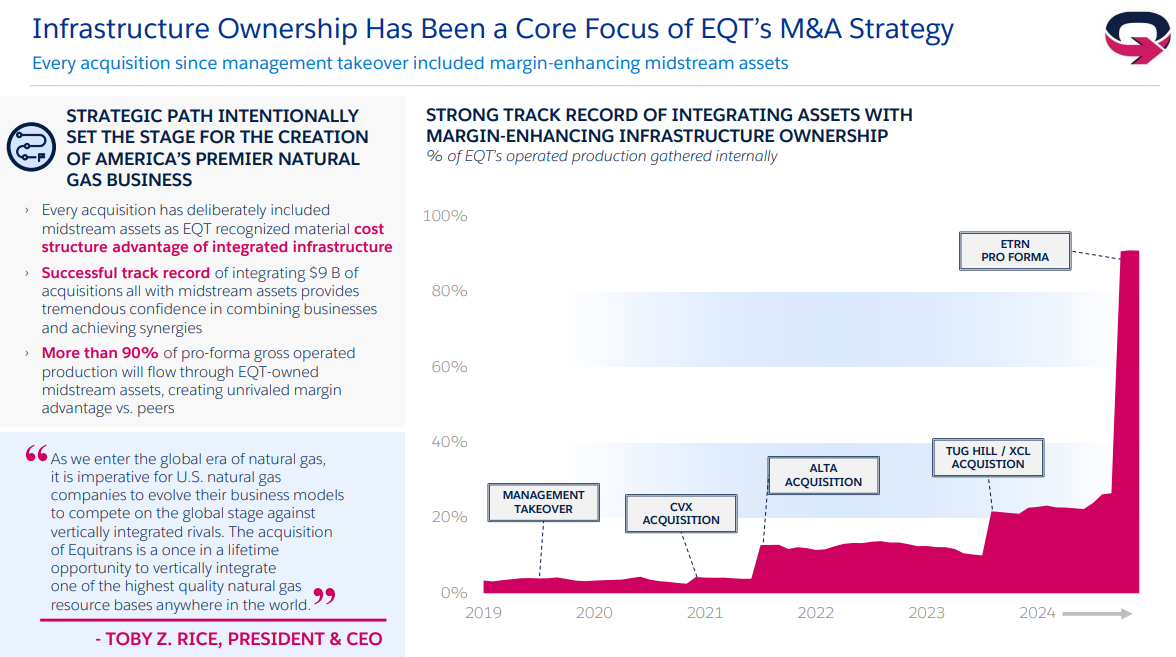

Equitrans was spun out of EQT in late 2018, before the Rice group gained control of EQT in 2019. Since then, the Rice brothers have acquired a number of vertically integrated gas producers, bringing the share of its gas production gathered internally from de minimis at the time of the takeover to nearly 20 percent today (see below). The Equitrans transaction will take this ratio to nearly 100 percent, with management claiming they will be able to deliver ~$425 million of annual synergies. Maybe, but so far the market response has been tepid, with EQT shares selling off about 12 percent since the announcement.

(EQT Corp)