What we're reading about, 2/20/24

Climate, energy, and sustainability coverage we've been following around the web

(1) Three leading US asset managers - JPMorgan Asset Management, State Street Global Advisors, and PIMCO - pulled out of the Climate Action 100+ (“CA100+”) investor coalition last week (Bloomberg, Financial Times, NYT). Combined, these three managers have about ~$3.4tn in equity assets under management (“AUM”), dealing a significant blow to CA100+’s financial clout.

CA100+ is a project to align investors on shared engagement and proxy voting policies for the world’s biggest emitters. The firms that quit the initiative last week complained that the project’s shift to “Phase 2” - announced last June - would compromise the independence of their stewardship efforts, or even conflict with their fiduciary duties:

“SSGA has concluded the enhanced Climate Action 100+ phase 2 requirements for signatories are not consistent with our independent approach to proxy voting and portfolio company engagement.” (SSGA)

“Given these strengths and the evolution of its own stewardship capabilities, [JPMorgan Asset Management] has determined that it will no longer participate in Climate Action 100+ engagements.” (JPMorgan)

(2) The “big three” index fund providers (BlackRock, Vanguard, and SSGA) continue to expand “voting choice” - the devolution of proxy voting decisions to retail investors. Generally, these programs allow clients to pick from a range of “off-the-shelf voting policies” provided by proxy advisory firms (ISS and Glass-Lewis) or an asset manager’s own proxy research team.

Over the last ~15 months (from Q3 2022 to Q4 2023), BlackRock expanded Voting Choice eligibility from ~$1.8tn in equity index fund assets to ~$2.6tn (about half of BlackRock’s total equity AUM).

However, enthusiasm may be waning. In Q3 2022, clients holding ~25% of eligible assets opted for Voting Choice; in Q4 2023, that total had fallen to ~23%, on a higher base. Simplistically, client assets exercising voting choice increased by ~$146bn, while eligible assets increased by ~$800bn, so the incremental opt-in rate fell to around ~18%. (BlackRock)

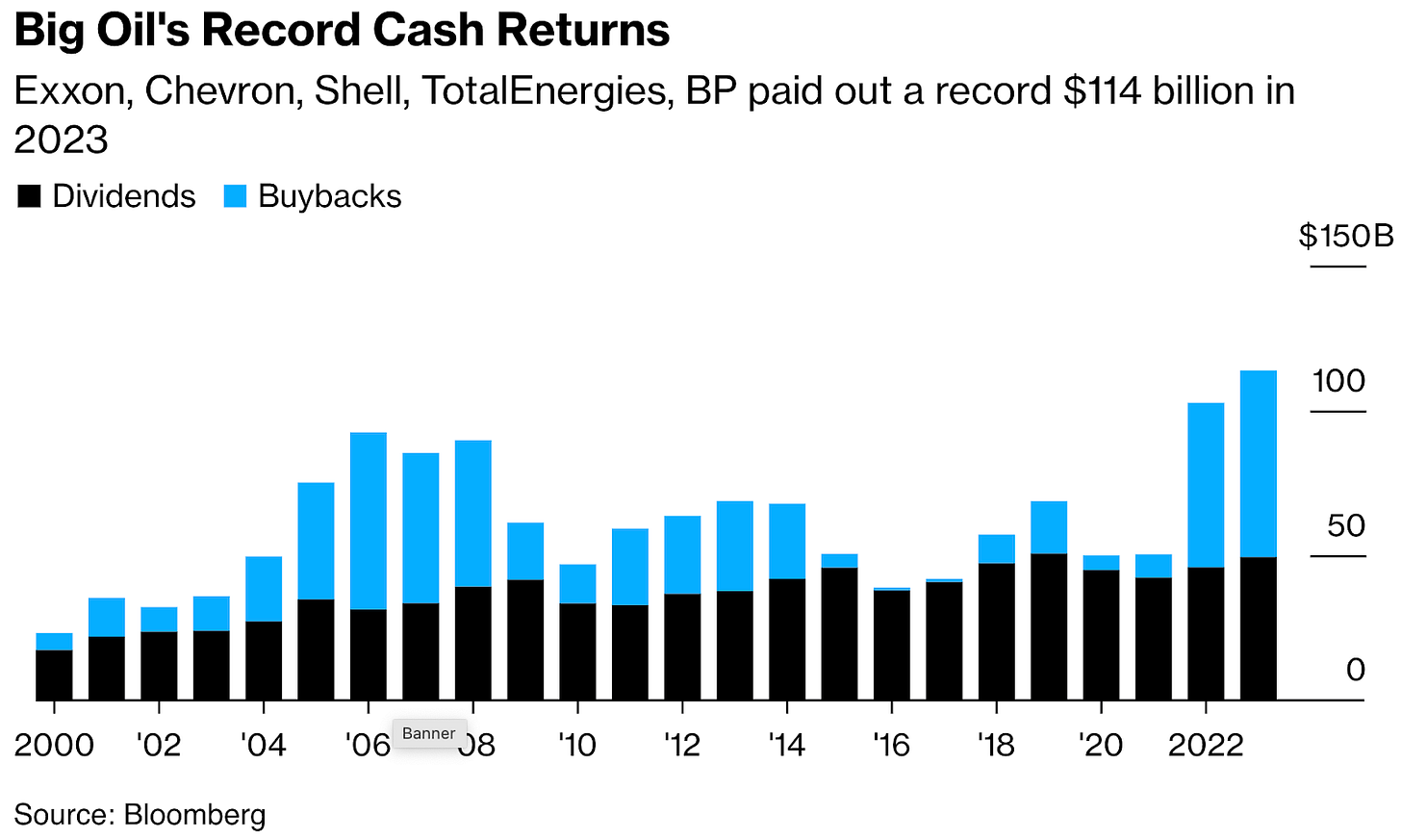

(3) Cumulatively, the Western integrated oils (ExxonMobil, Chevron, Shell, Total, and BP), returned $114bn of capital to shareholders as dividends and share repurchases in 2023, a 10% increase from 2022. Bloomberg’s Kevin Crowley notes that last year’s dividends and buybacks were 76% higher than the average shareholder payout from 2011-2014, the last time when crude prices stayed above $70 per barrel for any length of time. (Bloomberg)

(5) Diamondback Energy (FANG) and Endeavor Energy (private) are merging, with FANG offering 117.3m shares and $8bn in cash as consideration for the privately held driller, valuing the company at $26bn. Endeavor’s 2024 guidance calls for ~350-365 MBOE/d of production, and capital spending of ~$2.5-2.6bn, versus 458-466 MBOE/d per day of production and $2.3-2.55bn in capital spending for standalone Diamondback. The merged company is expected to produce ~470-480 MBO/d (800-825 MBOE/d incl. natural gas) in 2025, a substantial level relative to overall crude production in Texas.

(6) A recent FTSE Russell report making the rounds highlights some of the challenges in making sense of “Scope 3” (value chain) emissions disclosures. Mandatory Scope 3 disclosures are coming in the EU, Japan, and California over the next two to three years, but, as the report points out, Scope 3 emissions are plagued by comparability and data quality issues - under the GHG Protocol’s standards for emissions reporting, companies can choose which Scope 3 categories to report, which means that comparisons between companies (and even over multiple years of data for one company) are often apples to oranges.

(7) Per NYT’s Hiroko Tabuchi, Bank of America appears to have walked back a 2021 commitment to “not directly finance new thermal coal mines or the expansion of existing mines [or oil and gas exploration in the Arctic Circle],” instead subjecting these projects to an “enhanced due diligence process” that leaves the door open to funding them.